The first 5G smartphones are just making their way onto the market. But the motivation for consumers to buy them is turning out to be pretty weak. At the moment, only very few consumer apps need the bandwidths and especially the low latencies that a 5G infrastructure can offer. In addition, 5G consumer apps are dependent on network coverage. Even though Deutsche Telekom chief Timo Höttges announced at the end of 2020 that he would be able to reach up to 80% of the German population with 5G by the end of 2021, the background to the calculation is clear. His roll-out priority – with 45,000 5G antennas already in place today – is initially focused on metropolitan areas. As can easily be seen on the official maps of the providers’ current network coverage, Vodafone is pursuing a similar strategy. In Austria, outside the metropolises of Vienna, Salzburg, and Linz, coverage is even limited to only the main roads. This means that the originally discussed 5G killer apps for smartphones are still the exception. But fortunately, 5G was able to come up with a variety of use cases from the IoT, industrial, automotive, and medical sectors that matched the technological promise of more bandwidth, lower latency, and better energy efficiency. Industrial manufacturing is circumventing the network coverage dilemma by having larger companies build local “campus networks” for 5G and thus connect their robots and manufacturing equipment. Even if this helps some car manufacturers and suppliers with their production, campus networks are no help for the 5G application in vehicle use itself.

This Cloudflight Analyst View therefore specifically questions the status quo and the strategy of the automotive industry, which had high hopes that 5G would once again make its products more attractive and develop new capabilities.

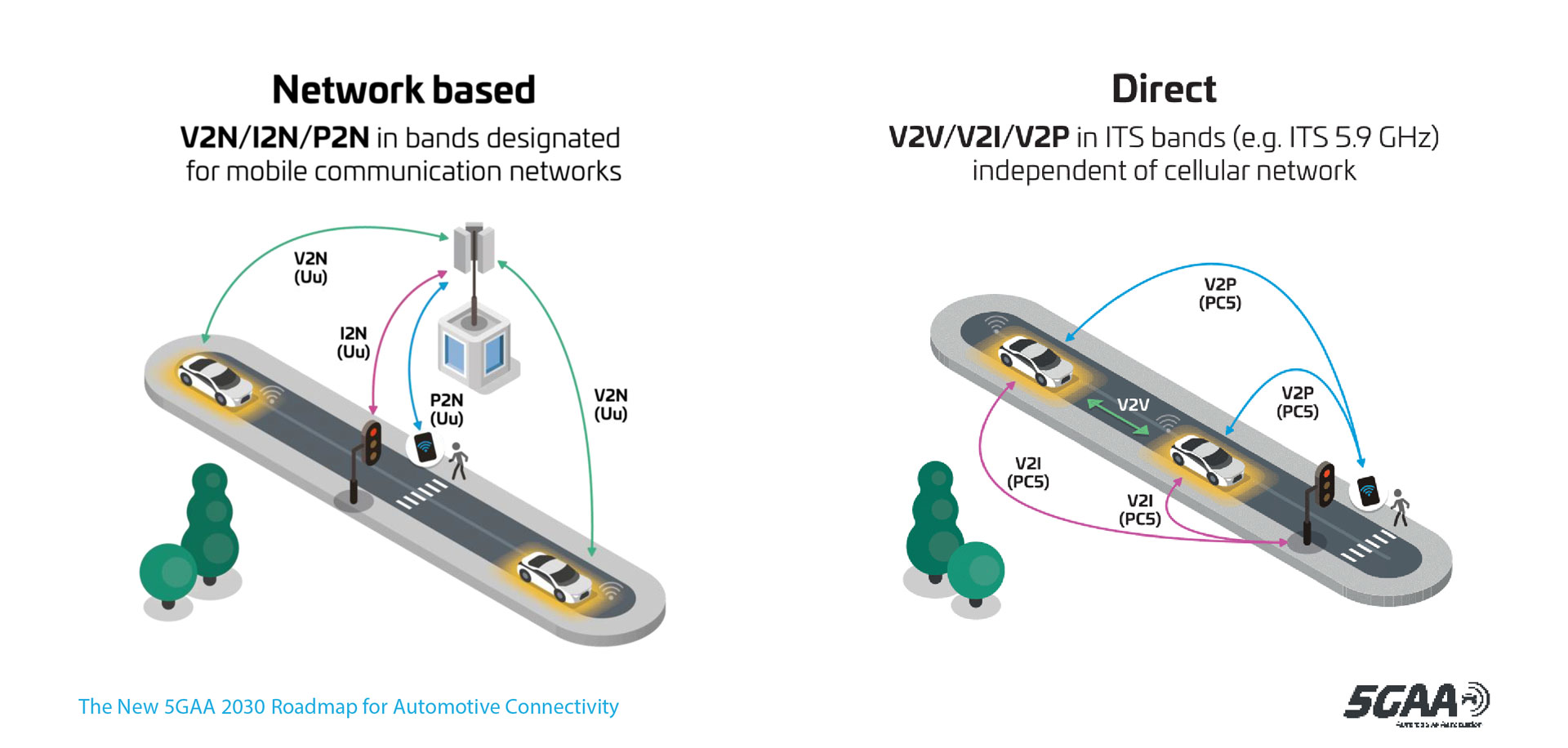

The modern mobile radio applications for cars use V2X communication. This means communication between the vehicle and other vehicles, infrastructure (e.g. traffic lights or parking sensors), and personal smartphones.

(Source: 5GAA.Org)In traditional mobile radio (on the left), all participants communicate via the mobile radio network infrastructure. This communication is called V2N for vehicles, P2N for people, and I2N for transport infrastructure. For example, all IoT scenarios that remotely control traffic lights are currently built this way. This means that fast communication in traffic is dependent not only on network coverage but also on the high availability of the network itself. Examples such as the collision warning before a traffic congestion would no longer work in most tunnels. V2X, in contrast, stands for direct communication between vehicles and one of the three other participants. Vehicles can then publish their sensor information directly and without a transmission mast to following vehicles – regardless of whether they are in a tunnel. In the same way, traffic lights can “publish” their green wave early via V2X – even if they are not even on the high-speed 5G network. The car can thus avoid unnecessary stops or traffic congestion in city traffic by adapting its speed. Communication between vehicles and personal smartphones could also eventually be possible with this standard. Even though human drivers, just like autonomous systems, must detect a pedestrian at a zebra crossing with optical and radar sensors, radio transmission would provide additional safety in situations that are difficult or impossible to observe. How often are cyclists overlooked when turning right or people are on road run over after a breakdown or accident? Many of these serious accidents could be avoided through consistent vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and ultimately vehicle-to-person (V2P) communication to complement traditional vehicle-to-network (V2N).

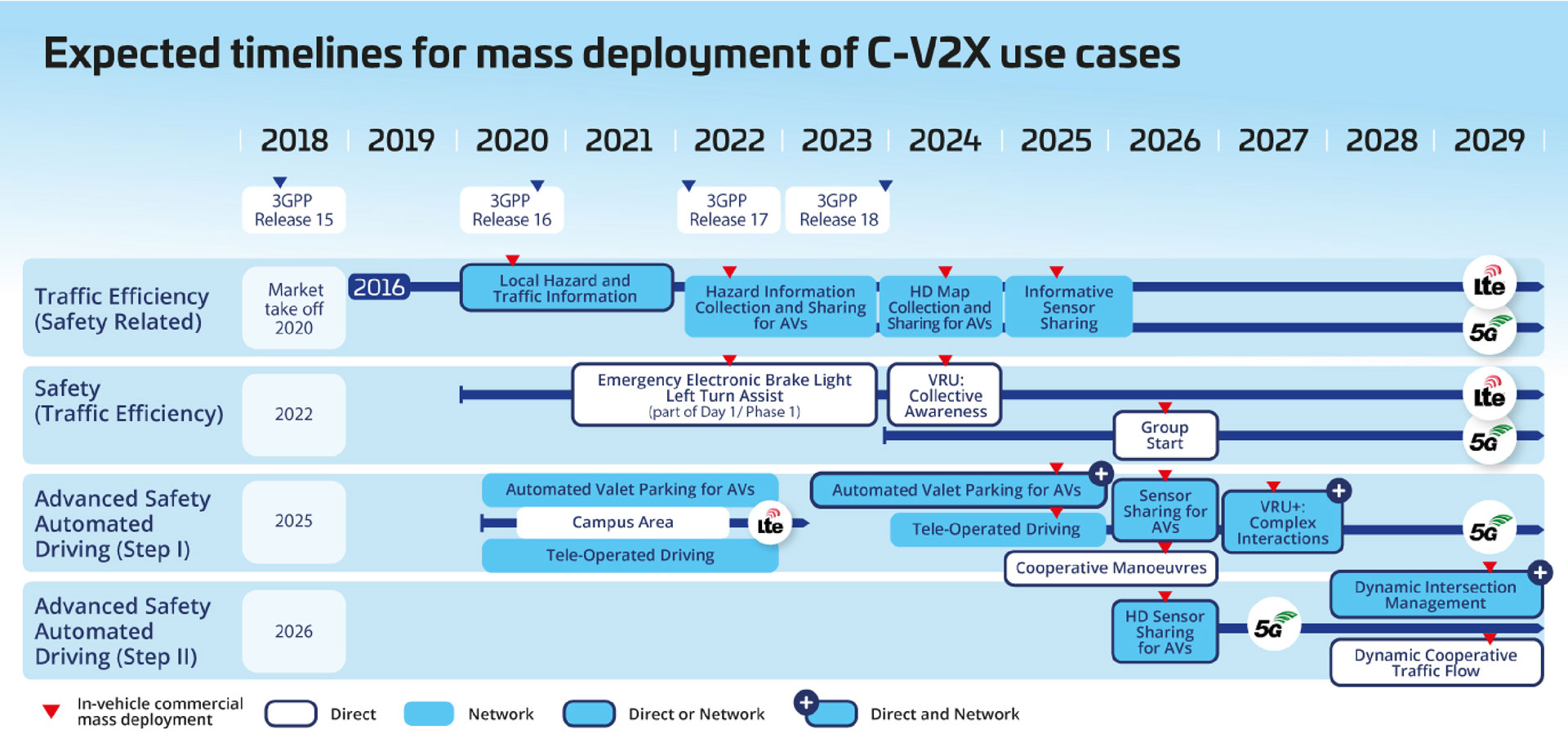

In order to achieve this goal, synchronised work on standards and protocols worldwide as well as unprecedented coordination between the telecommunications and automotive industries are essential. For this very purpose, the 5G Automotive Association (5GAA.org) was formed around the eight founding members AUDI AG, BMW Group, Daimler AG, Ericsson, Huawei, Intel, Nokia, and Qualcomm in September 2016. Cloudflight therefore spoke to insiders at the 5GAA, which now counts 130 companies from Europe, Asia, and the US among its members. In addition to the detailed work on the technical specifications, the publication of the 5GAA roadmap provides a realistic estimate of when which scenarios will be supported by current new cars:

(Source: 5GAA.org)In December 2020, the 5GAA adopted this current time line in detail. It outlines the planned releases of the standard specification of the 3rd Generation Partnership Project (3GPP), which, in turn, synchronises the world’s leading telecommunications standards organisations and is thus the actual 5G standard. As a lobby between telecommunications companies and the automotive industry, the 5GAA shows in its time line which use cases are being addressed or are possible with which 5G standard.

If you buy a new 5G smartphone today, it will have 5G chips built into it according to the 2018 Release 15. Thus, “only” two years have passed between the specification and consumer device availability. However, the conclusion that 5G has also arrived in cars at the same time is unfortunately wrong. Today, even modern passenger cars are delivered with a mobile radio chip set in accordance with LTE Release 14. Although this enables LTE-V2X communications (on the road in China since December 2020 and in the US in the first half of 2021), it is far from 5G. In competition with LTE and 5G-V2X communications, which are preferred by the 5GAA, there is also ad-hoc Wi-Fi communication between vehicles (ETSI ITS-G5 / IEEE802.11p), which is installed in the VW Golf 8, for example, and is independent of the telecommunications network. In fact, it is the most widely used V2X technology today. This will not be considered further here because we believe that unified V2X and V2N (i.e. direct and network communication) will be more successful in the long term. In addition, upper level message formats or security protocols can be transported from ITS-G5 to LTE-V2X and 5G-V2X.

In accordance with a 10-year-old EU directive, Europe is waiting for the real 5G for V2X scenarios on the road. Only releases 15 to 18 shown above are referred to as 5G. Unfortunately, 5G Release 15 is mainly a consumer device release. Vehicle manufacturers for the European market are therefore waiting for the availability of Release 16, which will finally support important automotive features such as Groupcast and One-2-One Broadcast. For example, Groupcast is the joint moving off or braking of a group of vehicles based on standardised direct communication. Although this release was defined as ready by the end of 2020, it will probably take until the end of 2025 until the first production vehicles have this first real 5G automotive release with the appropriate chip sets installed. It will thus be 2026 by the time we see large numbers of cars behaving like a “swarm” thanks to 5G technology or talking to each other when merging into a lane. Then, in the V2X area, the current LTE V2X (R14) and this first 5G V2X (R16) standard will still compete on the market for a while. Unfortunately, these two standards are not exactly compatible, and the market momentum wanes. Of course, it is already possible to realise scenarios in proprietary fleet solutions such as the interconnected driving of several trucks, which Daimler had already demonstrated some time ago. However, only implementation based on a cross-manufacturer standard enables interaction with vehicles from other manufacturers on the road.

It is likely that before 2025, there will also be premium vehicles that have a mixture of 5G (R15) (e.g. in order to already have access to the larger bandwidth) and an older LTE V2X chip set (R14) in order to cover V2X communications that the R15-5G cannot yet manage.

All in all, this is a rather “messy” situation for the automotive OEMs, the suppliers, and especially the third-party transport infrastructure ecosystem. The latter are suppliers of level 4 autonomous car parks (automated valet parking) as can already be seen today at Stuttgart Airport in a pilot facility. They have to implement two completely different standards within five years. Today’s LTE-V2X vehicles use different chips, frequencies, and software than the 5G-V2X that will be delivered from 2025. Quite understandably, many innovations are completely slowed down by the tough start-up phase. For example, car innovator Tesla has so far stayed completely out of V2X communication. However, the automotive industry was hit even harder by the fact that the major smartphone manufacturers abruptly abandoned the idea of installing V2X chips in their devices. Because the number of vehicles with LTE-V2X is simply too small compared with the number of smartphones and because the EU places great demands on the privacy rights of citizens, Apple, Samsung, and others have completely dispensed with the use of LTE-V2x (R14) chips in smartphones. Therefore, no new vehicle will be able to communicate with a consumer smartphone via V2X standards – either today or in the next four to five years. Simple things like opening a car already require proprietary communication solutions – as we looked at with Tesla’s digital twin. Safety-related or multi-vendor scenarios (e.g. warning pedestrians in a tunnel) remain completely impossible – even if people are carrying the latest 5G smartphones. This has cost the car industry a great deal of credibility and market momentum.

Based on our discussions and projects with insiders in the automotive and telecommunications industries, the situation could be changed in the long term by implementing the following measures – preferably in parallel:

- Increased decoupling or modularisation of hardware and software in the vehicle. Traditionally, the major suppliers such as Bosch and Continental deliver control units with software to the car OEMs ready for installation. The decoupling of hardware and software has already been identified as one of the Cloudflight 2021 trends in the Embedded World. The industry may gain more momentum if the solid and conservatively planned hardware comes from a traditional manufacturer but the software comes from the car OEM itself (in a timely manner with the model update) or an agile software service provider. In this way, devices from different hardware manufacturers could also run with a single software stack, for example, as Daimler is already looking at in their cooperation with NVIDIA and Waymo (Google) in autonomous driving.

- Agile implementation of 5G V2X technology in vehicles. Today, modern business software is developed in an agile (i.e. incremental) way. However, control units for vehicles are usually still developed according to the classic waterfall principle. This is actually appropriate for hardware that is installed once and then remains unchanged in the vehicle for a long time. However, vehicle manufacturers must find new ways to keep their fleets attractive – even after production. The vehicle industry should therefore install LTE & 5G hardware with multi-band antennas as early as possible – even if the software initially only uses the LTE side. Tesla is showing the industry how a hardware release stays in the vehicle for its entire life, even though the software can be continuously upgraded. Ultimately, innovation will be faster in more vehicles, and even 2–4 year old vehicles will still be compatible with new vehicles in a fleet and on public roads.

- 5G multi-access edge computing as an integral part of V2X communication. One of the biggest promises of 5G is the very low latency. An example scenario is the updating of map changes such as detours or speed limits. How quickly the information is published by a Daimler, for example, and displayed by a BMW driving behind is the end-to-end latency of the applications. In order to truly achieve this, it is not enough to think in terms of classic software topologies. Between the vehicle and a central cloud of the vehicle manufacturer, for example, the navigation logic must also be on the multi-access or 5G edge. Already here, manufacturers must exchange anonymised telematics data in order to bring the latency of the applications across manufacturers and network carriers to below one second. The vehicle industry needs to work with cloud computing experts who are familiar with the Edge Cloud solutions of the hyperscalers (AWS Wavelength, Google GMEC, and Microsoft Azure for Operators).

- High-speed digital twins as an abstraction between LTE and 5G. The years-long transition from LTE-V2X to 5G-V2X by 2026 shows just how dangerous incompatible technology waves are. In order to be able to offer easier interoperability to the automotive ecosystem, an abstraction of the respective V2X protocol should already take place on the Edge Cloud. And cross-protocol remote access should also be made possible in the vehicle itself. The concept of a digital twin in combination with remote access to vehicles is one solution that we have already described in detail.

- Quick clarification of the legal situation in the EU. Manufacturers sometimes struggle with glaring gaps in the legal situation. For example, a 5GAA insider told Cloudflight that “The EU has not yet decided how cars deal with intersections”. This refers to an unclear or obstructive legal situation regarding video recognition and processing in vehicles. For example, while it is tolerated for autonomous Level 2 vehicles to evaluate video footage on motorways, European case law prohibits recording at intersections because pedestrians could also be filmed here. There have long been proposals for solutions such as anonymisation through imaging in the IR spectrum. Bosch has had this programmed directly into cameras for years. In this way, people are clearly recognised as people, but their personal rights remain completely protected and anonymous. Unfortunately, the vehicle industry has been waiting for years for a clear legal situation, which already exists in China and the US. This continues to cost pedestrians their lives and European manufacturers important competitive advantages at the international level.

- Lobbying to mandate technologies. Many innovations in the automotive industry have only prevailed because there was a legal mandate to do so. Without such regulations, there would be no airbag, catalyzer or soot filter, or exemplary exhaust emission standard in all new cars today. Why aren’t legislators and governments in European countries stepping forward and mandating the upcoming 5G V2X technology for new cars now? This would prevent countless rear-end collisions in poor visibility or collisions with pedestrians. Smartphone manufacturers could regain confidence in the vehicle industry regarding V2X and communicate with the digital twins mentioned above until real 5G V2X vehicles are on the roads from the end of 2025. While such technology mandates are an intervention in the free market economy, stimulus programs for new purchases of a certain type of drive are much more so.

In summary, it is actually far too early to decide whether 5G in cars is a flop or the super killer app that motivates us to buy new cars. So far, the car lobby has already intervened in 5G development and, for example, obtained a commitment from telecom companies to first build 5G availability along roads. The car industry is still a long way from the above six-point plan. In order to implement this, the entire industry would have to engage in a much more focused digital transformation.

CEOs and development managers in the automotive industry might not see 5G as just “another wave of technology” that their suppliers squeeze into ECUs and then integrate into the vehicle. It is time to think fundamentally about how vehicle manufacturers deal with software-driven technology. 5G is half software, but the perception of buyers is now 100% software. Only with a new software strategy can a vehicle manufacturer of the future also become a software supplier on a multi-access Edge Cloud without which its vehicles will be less attractive in the long term. After Industry 4.0 in manufacturing and cloud computing in enterprise software systems, the vehicle itself is now facing the biggest change towards a truly connected world. This is a transformation in all areas: Hardware, software, supply chain, and after-sales ecosystem. And this is not just about technology but rather very much about people, corporate mind-set, and the redefinition of the value proposition of the automotive industry.