Learn how to apply the Cloudflight Technology Focus methodology to your own company

The overall success of a company or a larger enterprise depends on many factors. Some companies build on a dominant market share in a commodity market and harvest their monopoly. But an increasing number of companies are relying on a differentiating value proposition based upon innovation. Even for the current monopolists, the long-term defense of their position might require innovation – and it may happen sooner than expected. At least that’s at our conclusion based on the sudden struggle or even disappearance of monopolists with major brands from Kodak to Nokia. Once CXOs or other strategists embrace innovation as a current or future pillar of the corporate strategy, it becomes obvious that there are multiple forms of innovation. You might consider new business models such as equipment-as-a-service or adapt your service or production depth and totally change the way you bring your products to the market. You also might change the way you attract new employees if talent is the critical success factor. We’ve seen and helped quite a few companies on this journey and have always seen technology as a key enabler to foster any kind of innovation in most companies.

In particular, companies in a commodity business or large market leaders outside the high-tech industry tend to struggle with their technology strategy. If you simply invest in the same “hype” technology as everyone else, it is neither a differentiator nor a way to attract skilled young talent. Equally, if CXOs and strategists allow every division make some small investments and have no corporate innovation investment strategy, this will lead to scattered technological innovation and basically no strategy at all! The divisions that run low on margin have the biggest potential to disrupt the market with innovation because their competitors will most likely struggle with the same margin challenges. As our answer to the need for a structured approach to innovation, we’ve developed the Cloudflight’s Technology Focus methodology.

The technology focus can be applied in three different perspectives:

- General technology focus – is similar to existing trend reports but includes recommendations on how an average company should invest.

- Cloudflight’s own technology focus – explores which innovative software technologies Cloudflight is currently investing in.

- Custom technology focus – is your individual technology and innovation focus for your company. It is obviously different for each company and industry. You may or may not publish it to your customers.

This article explores the final focus only. It explains how you can create a “Custom technology focus” for your company and use it as part of the corporate strategy. Although it is useful having read the original article Cloudflight’s Technology Focus, this is not required.

Other innovation reports or technology focus maps might be used as inspiration for technologies you want to consider. However, the new perspective is the relevance for your company. External advisors can only help and moderate the creation of this perspective. They should never prescribe it for you because this is the major link to your corporate strategy, the core of your investment decisions, and your future differentiation.

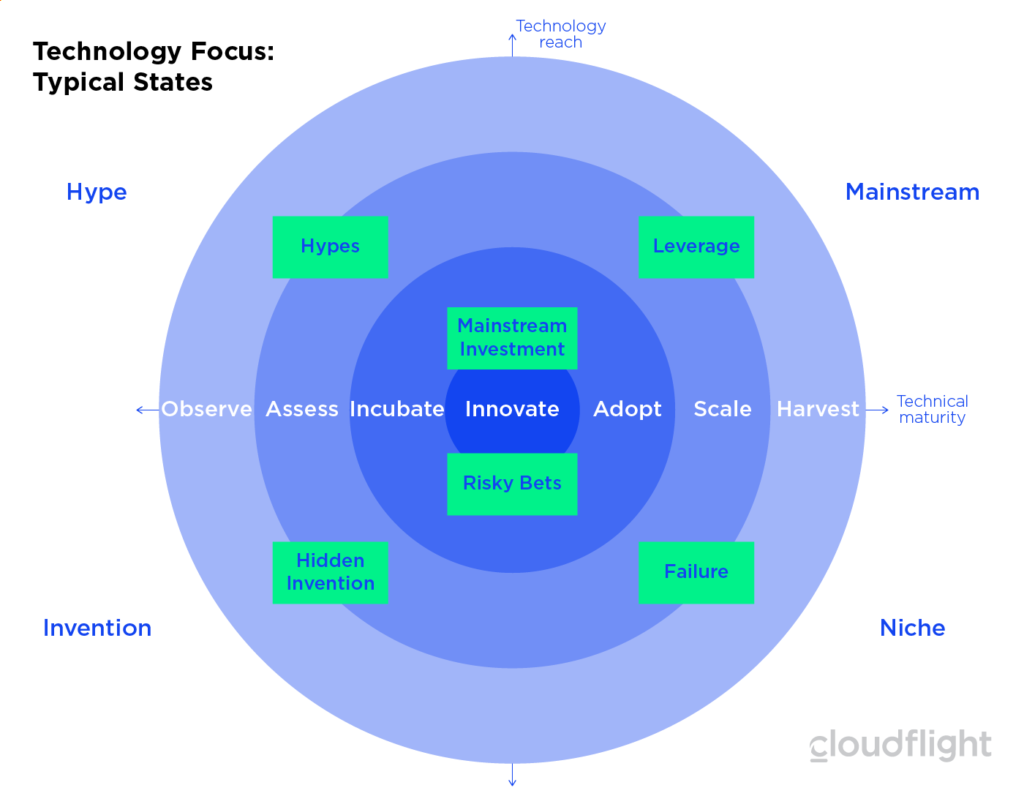

If a technology is at the left end of the focus, it might be too early to invest strategically beyond the research level or with a few trend scouts. If it is at the right end of the focus, it is too late to invest because these technologies have become mature and will no longer differentiate your corporation. They should be funded out of the operational margin of every division. In a nutshell, the dimensions of the visual have the following meaning:

- The x-axis from left to right shows the maturity in relation to your industry. Take quantum computing, for instance. For the scientific computing division of a university, this might be the middle of maturity and may be even in the center of the innovation focus. However, for a consumer goods company, the same technology is far left, immature, and still considered as a hidden invention or hype – if it is on the radar at all.

- The up/down-direction on the y-axis shows the adoption of your peers. Along the maturity from left to right, your peers may consider, invest, or finally use a certain technology. If only few companies observe it, it’s a hidden invention. If all your peers consider it, it’s a hype. If you feel a technology is potentially ready to invest in, you might consider it as a safe mainstream investment or a risky bet. Again, this depends on the behavior of your peers. You may also consciously ignore well known technology or hidden niche technology and keep it away from an investment focus. It is then either far above or below your innovation focus. At a later stage, a certain technology is most likely either a widely leveraged technology amongst your peers or a hardly used failure.

- The distance from the center shows the relevance for your own company. Obviously, these technologies that are close to the bull’s eye have received the most attention – whether they came from a hype or you scouted a hidden invention on your own. At higher maturity (right half of the target), technology tends to diverge again into mainstream technologies used only in a productive environment or niches. Both should not be stimulated with innovation funding beyond their operational usage.

The last criterion of own relevance is the most crucial measurement to set up your individual technology focus. It includes strategic company objectives, in-house expertise, go-to-market potential, possible profitability, sustainability of the technology, and the level of disruption related to previous technologies. Based on this description, experienced strategists could easily compile a scorecard spreadsheet, which describes the position on the target for each emerging or mature technology you are considering in your innovation strategy.

Please contact Cloudflight’s consulting services

Technological Innovation always moves at fast pace!

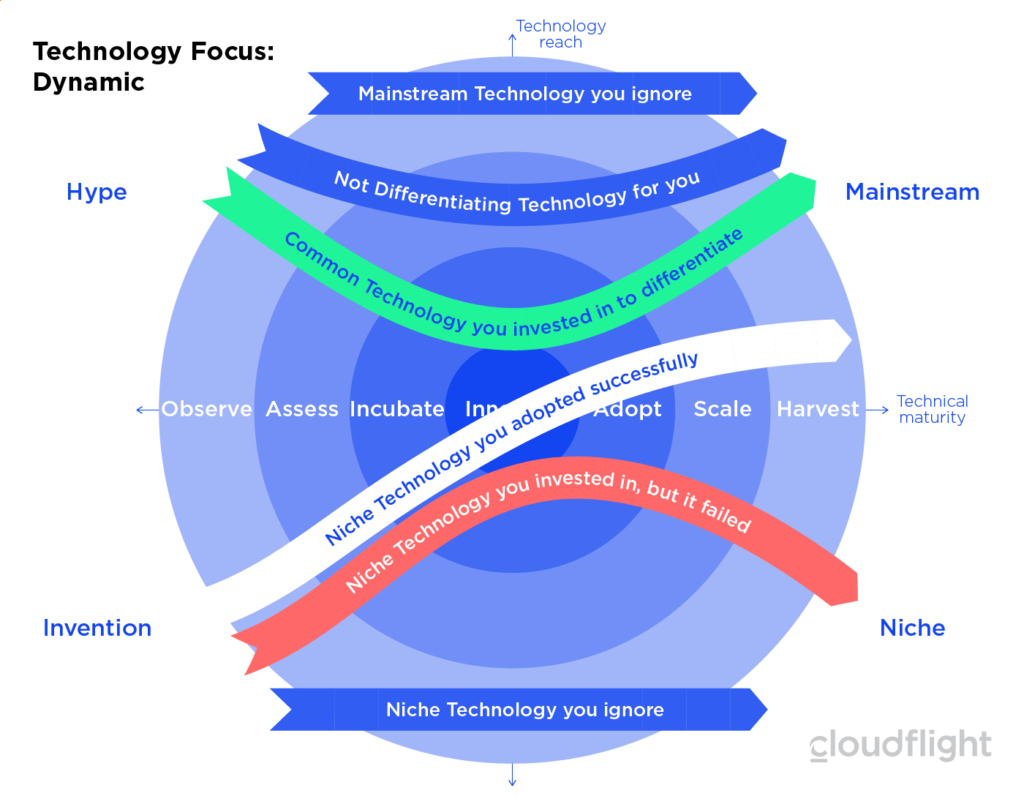

Although the dynamic of Cloudflight’s technology focus has been published in the initial report, we’d like to have a look at it with your individual technology focus in mind. If you update it every quarter, you will notice that each technology will have a track over time.

- SAP Hana – differentiating or non-differentiating mainstream. SAP Hana is the base platform of SAP’s S/4 ERP system and recently an increasing number of industry solutions by SAP and its ecosystem. Some customers invested at an early stage of the technology and decided that it was already mature enough for them to engage. This is the green track. The Hana technology is generally mature today. Customers that engage today should therefore not invest innovation budget into it beyond the typical cost of a production facility because most of their peers are doing the same. Hana as a platform became a “Non-differentiating technology” in its industry. Over time, the advantage of early adaptors blurred for such a commonly available technology. That’s why the green and blue tracks eventually merged after a few years.

- Real-time operating systems – A failing investment for many companies. In the late 1970s and early 1980s, the first Windows and Linux operating systems were running on the early Intel 8086 CPUs. These operating systems were hardly able to keep up with the expected response time. Around this time, many companies looked at Real-time operating systems to operate machines, robots, or industrial processing equipment that require more immediate responses from the emerging computers. However, the ecosystem around these real-time operating systems never took off. At the same time, a distributed controller took the real-time tasks embedded into machines and robots – directly coded in C/C++ – while the central visualization, human interaction, SCADA, or industrial processing, including many OPC-UA processes, ran on the mainstream Windows or Linux distribution (with a few performance tweaks). Today, the large scale real-time operating systems are clearly a niche for most vendors that originally invested into the concept more than 30 years ago. Modern x86 Windows systems are simply fast enough for most of their tasks; these are not distributed to embedded real-time systems that do not need a full operating system. However, if you are, for example, a vendor of autonomous driving software or an automotive OEM, you might see things You might want to have a portable software implementation of time-critical driving solutions across multiple hardware vendors. A modern version of a powerful real-time operating system might thus be a risky-bet stage for you – but a reasonable modern consideration! This is where, for example, Volkswagen and Daimler stand with their “Car”-OSes. That’s why, as we pointed out above, the maturity of a technology needs to be scored in relation to your industry!

- Custom built business software – the secret source of differentiation. For two decades, retailers and logistics companies tried to replace their old mainframe or minicomputer-based software with standard packaged software from ERP vendors. Custom business software became a failing niche for many retailer and logistics companies. This is illustrated with the red track in the above picture. However, some large retailers like OTTO Group or Schwarz/Lidl and definitely Amazon, which tried adopting packaged solutions, simply saw that the total cost of ownership after many changes is high and that they gained no long-term differentiation (green track). At the same time, the landscape underwent massive consolidation, and transaction volumes grew in a single company. Depending on the size and desired differentiation, it may make sense to adopt a niche technology or write core business software of your own. This technology will obviously never be a mainstream also used by your competitors. But if adopted by a single company or a narrow partner ecosystem, it can become a long-term differentiator as illustrated by the white track in the above picture. The pan-European logistics provider LKW-Walter, for example, is following the same route of a digital differentiation based on custom software.

How to get started?

Start with creating a scorecard for technological maturity in your specific industry, adoption amongst your most relevant peers, and personal relevance as a company. This is the basis for determining the positions on the technology focus map.

Next, evaluate all technologies that you are aware of or which employees, suppliers, or customers ask you to invest in using these scorecards. If you need help, you can ask Cloudflight for advice or help in creating a scorecard template for your industry and your company.

The initial result will show a static picture and provide you with an immediate recommendation on how to draw up your innovation budget. The methodology will also allow you to periodically score the technologies currently under consideration – and any upcoming ones – with the same scorecard in order to chart the dynamic.

This structured approach to innovation will result in a better adoption with less money invested and ultimately a much stronger differentiation or faster implementation of disruptive changes.

Rolling this out to a large corporation or customers and suppliers is definitely a community challenge. That’s why Cloudflight will publish another article with guidelines based on our experience in the implementation of this strategy framework. Stay tuned!

Get our free interactive Tech Focus now!

Our experts developed an Excel worksheet you can use to identify which technologies are more relevant to your company.

Fill in the form below – you will receive the Tech Focus via email!