Big Blue finally gets serious about Multi Cloud

Just before Christmas, IBM announced the acquisition of Helsinki-based multi-cloud specialist Nordcloud. The news follows numerous other acquisitions by IBM in recent months, as well as the announcement to spin off the infrastructure business into the so-called Newco and focus on cloud and software services in the core business.

For both companies, this move can prove to be a big gamble. After all, IBM has never really shown the multi-cloud commitment that it currently needs in the market, despite some acquisitions, such as Red Hat in particular last year. However, the signal effect of this deal shows that the step was probably necessary. Conversely, not all of the acquired companies in the IBM Group have been really successful afterwards and some of them had to find themselves in insignificance after a few months. This fate should be avoided for Nordcloud in IBM’s place, as it needs the impetus of the multi-cloud professionals in the dusty hybrid cloud tanker more urgently than ever.

What the Nordcloud acquisition means – and why it was urgently needed

IBM has been on a very idiosyncratic – but not necessarily unsuccessful – cloud course until recently. While the hyperscalers Google, AWS and Microsoft have completely dedicated their business to public cloud platforms and have fought each other on price, platform services and management level, IBM has strongly pushed the vendor lock-in into its hybrid cloud. As a result, hyperscalers were only run as an unwelcome add-on for customers but the focus was on a powerful and thoroughly “big blue” IT architecture.

This was particularly appealing to large and more cloud-averse enterprises. However, IBM was never able to match the speed of innovation and the growth of hyperscalers in this way. With the acquisition of Red Hat, IBM set a statement in typical fashion and secured one of the hottest open-source and cloud-native companies.

However, this ultimately also tended to build a fresh coat of paint and a functioning business alongside the traditional IBM – a real transformation and rethink never really emerged.

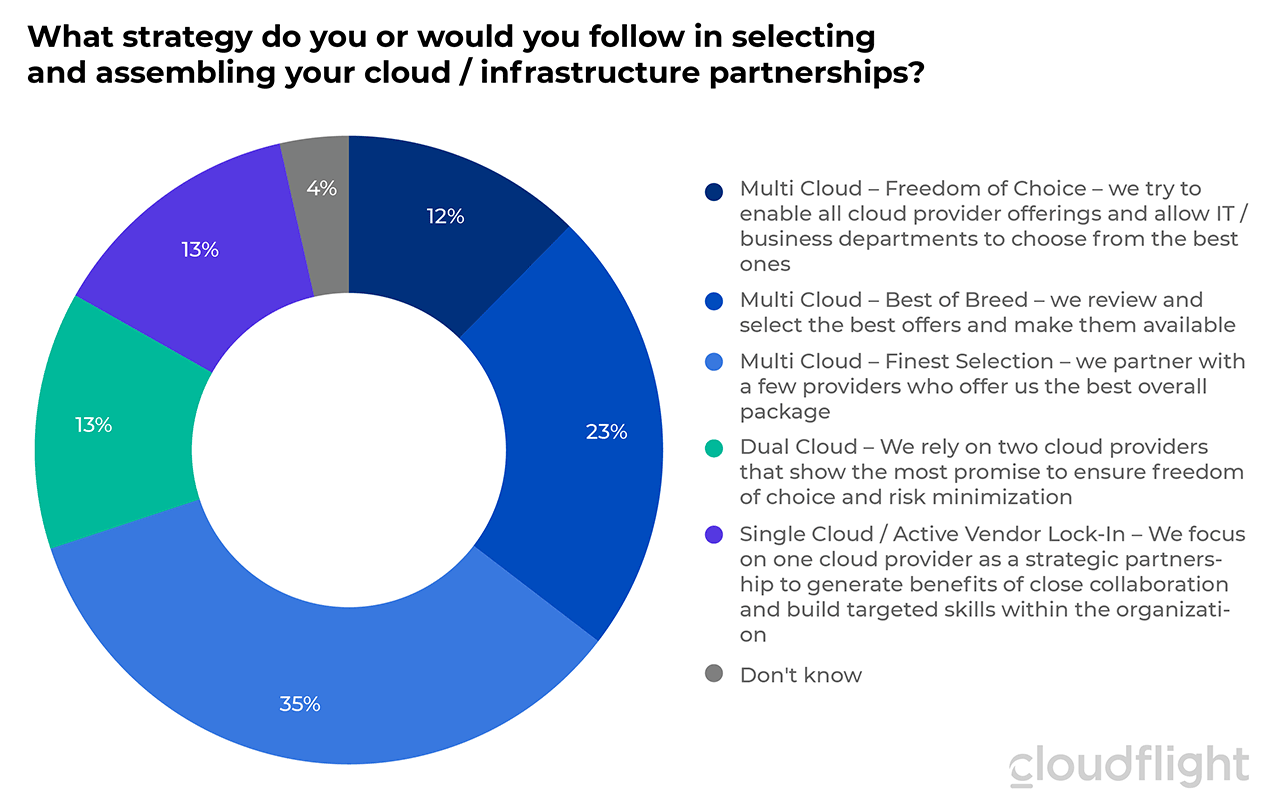

In the meantime, studies and experience within corporate IT confirm that the multi-cloud is set in terms of the sourcing mix for the digital infrastructure of the future. A current result of a study by Cloudflight’s independent brand Crisp Research, which has not yet been published, confirms that 70 percent of companies in the DACH region will also choose a multi-cloud approach for their IT landscapes in the future. In its trends for 2021, Cloudflight expects hybrid PaaS services, in particular, to be used across multiple cloud environments.

Over time, as the cloud has matured in Europe, Nordcloud has also become more of a holistic transformation partner, especially bringing the new business models and differentiating services to the public cloud and ensuring their operation.

Nordcloud and IBM, for example, have long interpreted and played the same target market differently. In our cloud microcosm, one could almost speak of a completely different worldview.

In reality, these extremes certainly blur, yet IBM should take advantage of the momentum of the fresh wind. Synergies from IBM’s cloud business of the past, in terms of size, depth of value creation and reach with its own products, with the multi-cloud expertise of Nordcloud, are more than obvious.

500 vs. 260,000 – Is Nordcloud enough for the new strategy?

A key question in the course of the deal, which has not yet been definitively answered, is whether Nordcloud will be fully absorbed within IBM or continue to operate independently.

Both options have their arguments for and against. On the one hand, a little more Nordcloud and multi-cloud mindset look good for IBM as a whole, but on the other hand, the very pointed Nordcloud portfolio should not disappear either, so as not to dilute the added value for existing and future customers.

Only recently it was said from IBM side that there will be no 10 billion dollar deals for the further cloud transformation. Given that, there are few to no companies in this league with such a clear multi-cloud portfolio, IBM is better off for it. Still, the deal’s radiance and impact must also be viewed realistically. 500 Nordcloud employees are compared to 260,000 IBM employees. Even if only one in five of them is to play the big multi-cloud story in the future, each Nordcloud employee would have to coach 100 IBM employees. By the time this is achieved, customers will already have moved to the competition to run their digital platforms, AI & IoT services on the public cloud.

7 years after Softlayer – is IBM making the same mistake again?

Consequently, IBM no longer has all the time in the world to deal with the appropriate integration and positioning strategy.

At the very least, it would not be the first time that IBM threw a major momentum of its own cloud transformation away. For a few months after the Softlayer acquisition, IBM had a promising standing in the public cloud services market. A firm belief in the fundamentals of IBM’s strategy has diluted that momentum to such an extent that there is little left anymore. When Softlayer was acquired then, the agility disappeared after IBM transferred virtually all of its infrastructure services to the Softlayer “division.” A speedboat just doesn’t pull oil tankers out of the harbour. To get it right this time, Nordcloud, indeed, needs to focus on the native multi-cloud business and IBM needs to consistently outsource the infrastructure business on customer hardware to Newco.

This would allow IBM to create a stringent portfolio that combines IBM’s enterprise and end-to-end expertise with Nordcloud’s multi-cloud expertise. In the constellation, IBM/Nordcloud can be one of the first companies that could control the hybrid multi cloud in Europe and beyond.

We can be curious to see whether both companies have given themselves the perfect Christmas present or whether it will prove to be more of a trade-in candidate.

Study on the topic:

In times of digitalization, the use of global public cloud platforms is becoming a matter of course. And not just in startups and digital departments, but now also in central corporate IT. Note: The study is available in German only.