A structured approach to innovation that matters to you

Adopting modern technologies has become a competitive consideration for a wide range of companies. Beyond software and hardware providers, basically every corporation – and even government agency – needs to consider technology today. There are thus numerous publications and frameworks of industry analyst firms that discuss the emerging technologies and analyze the adoption or the general market. However, most CIOs and CEOs we talk to are still puzzled when looking at these Waves, Hype Cycles, and Tech Adoption Cycles. These frameworks do not help to answer a key question for these roles: It might matter to some people – but does it matter to me?We address this dilemma with a new trend exploration methodology called Cloudflight’s “Technology Focus.” Leveraging market insight from both trend-scouting publications and Cloudflight’s expertise, the Focus also adds relevance to you, your team, and your company. We propose three different Technology Focus perspectives:

- General Technology Focus – a general user market view. This perspective addresses average user companies in Europe. It is not a vendor perspective and might not be valid for specific niche industries. Instead, it is a general guideline for CxOs and describes which technologies their peers are currently focusing their attention on.

- Cloudflight Technology Focus – Cloudflight’s signature technology strategy. Cloudflight is not only a market observer and digital strategy advisor but also a major implementation provider for cloud-native applications. We might prioritize some technologies or deliberately stay out of some areas that might be in full focus for other providers. This Technology Focus perspective is therefore helpful if you are a customer and would like to know if our strategy fits your plans.

- Custom Technology Focus – your individual technology focus. While the General and the Cloudflight Technology Focus are frequently published, this perspective is an advisory framework that we can compile for your company. It will help to communicate your company’s particular strategy and align all forces. This document is confidential for your company.

In this article, we present the Technology Focus methodology and publish the first version of the General Technology Focus perspective. This will be a good guideline for many CxOs regarding their investment decisions and highlights those technologies for which the decision for a certain strategy is most urgent. It provides the first outlook of whether the latest thing is really hot for you.

Technological progress never stops

We live in an ever-changing world in which technological progress is natural. While Generation Y still remembers a time without mobile phones, Generation Z grew up with smartphones. They are used to being constantly connected and having endless content at their fingertips. Looking into the mid-term future, some claim that the children born today will not even be allowed to drive a car anymore because autonomous vehicles will have become much safer than human drivers during the next 10 to 15 years . Here are some guiding thoughts behind Cloudflight’s approach to a Technology Focus.

Gates’ Law – we need a long-term methodology

Gates’ Law (often also called Amara’s Law or even attributed to others because the phrase has been picked up repeatedly in the past) states:

“Most people overestimate what they can achieve in a year and underestimate what they can achieve in 10 years.”

The logic behind this statement is that progress typically follows an exponential curve. However – and we know this from many examples – we humans are not so good at comprehending exponential growth and therefore flatten the speed of progress in our intuition. Here’s an example: if you currently have 1000 euros on your bank account, at a 1% interest rate, do you know what this will amount to after 10, 20, or even 50 years? Probably not. Or at the very least, it is hard to grasp.

Coming back to Gates’ law and the exponentiality of technological progress, the result is that innovations tend to be under development for some time. They start in an R&D context and then go from the first proof-of-concept implementation to a commercial environment. We frequently observe setbacks and skepticism. However, at some point, when the exponential speedup kicks in, technologies have their breakthrough; for those players on the market who have not yet been involved, it will be a tough struggle because they will have to either catch up or risk losing their businesses.

A recent example is Quantum Computing, where Fraunhofer and IBM recently presented Europe’s first 27 qbit Quantum Computer in Germany . The idea of Quantum Computing dates back to 1980 . It thus took about 30 years to reach a milestone that, despite being a great achievement, still has few real-world applications. However, we expect the amount of these applications to rise dramatically within the next few years.

Technology radars and adoption lifecycles

As mentioned above, the adoption and mass usage of new technologies is not always a one-way street. On the contrary, there is often such hype at the early stages of technologies that there is a phase of frustration during which business leaders or potential users become aware of certain limitations and constraints.

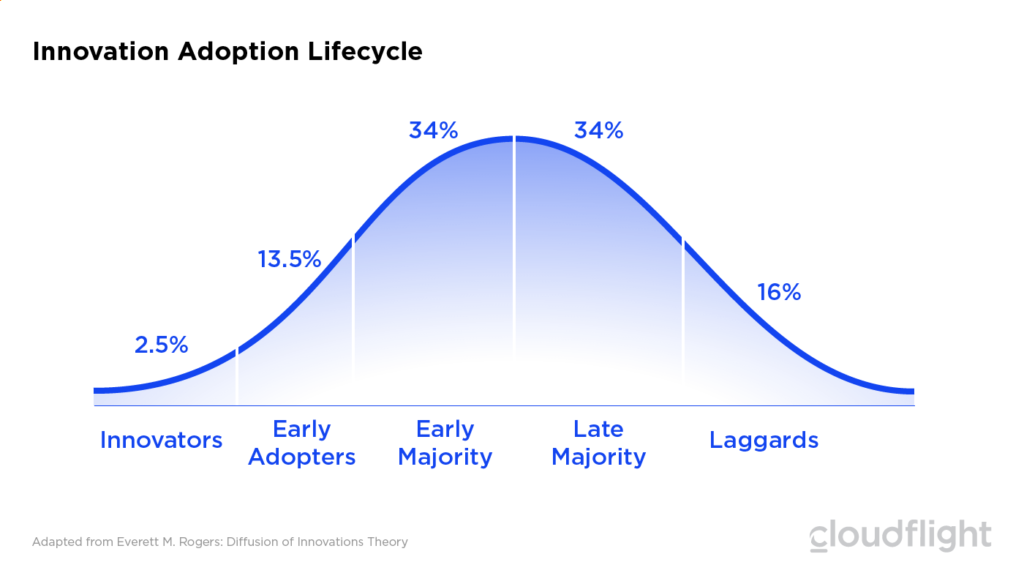

Several visualizations and publications have explored the maturity of technologies along such a lifecycle. An early one by Everett M. Rogers dates back to 1962, when he explained the diffusion of innovations process (Figure 1). Several other researchers and institutions later adopted it to describe technological life- and hype-cycles. The most recognized one was probably Geoffrey Moore’s extension of the model to discontinuous innovations in “Crossing the Chasm” . More IT-specific ones include the Forrester Research Technology Radar, the Thoughtworks Technology Radar, and the Gartner Hype Cycle.

Regardless of how we label the specific stages, we can generalize several phases:

- The technology is still at a relatively early stage. Driving innovators are investing in research but typically not doing any business with it at the time. Hypotheses on how to apply the technology are likely to either be wrong or falsified later in the development process, thereby leading to the development of new technologies. Nevertheless, the public is to some extent aware of the technology as the media starts picking up on the topic.

- The first success stories by early adopters pop up and lead to followers who try to replicate these successes or build upon them in expectation of increasing demand. In addition to the established players, we typically observe many start-ups focusing on these new technologies and funding becoming available. This bubble can lead to a peak of euphoria during which expectations significantly overrate the real impact of the technology.

- The first public failures occur after some successful cases. Development and progress hit a plateau, constraints appear, and start-ups go under. As a result, the hype stalls, and people think much more critically about the technology. While some developments might indeed stop again, this general sentiment does not necessarily correlate with actual progress still going on.

- Early mainstream adoption starts. As development continues and initial limitations are possibly behind, the benefit and value of the technology seem much more realistic, and use cases with positive short- to mid-term ROI become known. The potential hype level stabilizes, and actual technology maturity is the main opinion driver.

- The late majority finally drives mass adoption. People become used to it and integrate it into their workflows or private lives. As technological progress advances, the focus can shift to ethical questions with potential regulations to the technology. At some point, it is no longer perceived as innovative but rather as the updated standard. From a business perspective, the market saturates, and established players have secured their market shares.

- Conservative laggards avoid new technology despite mass adoption. According to Rogers , who describes these phases with a Gaussian distribution, those laggards are as common as innovators and early adopters. These phobics will also switch technologies eventually – but only if external pressure or the lack of alternatives forces them to do so.

Research such as the Gartner Hype Cycle for Emerging Technologies helps companies keep an overview of ongoing innovations and development. However, it does not answer the question about relevance to you or your peer group, or whether to invest in a technology. With maturity being the only dimension of the hype cycle, it does not tell much about actual demand or about markets, their volumes, their entry barriers, or the state of competition.

So how do you know which technologies to keep an eye on? At Cloudflight, we are proud of highly motivated people who try out new technologies also in their private life. They automate their homes, drive digitalization in the context of various hobbies, and develop small apps on their own. Thus, for each new field, it is likely that we will find a small team of people with at least some knowledge. However, this is not sufficient when offering large projects at scale or in production under hard SLAs. This requires a strategic approach and manifestation of specific fields of expertise in the organization.

The Technology Focus methodology by Cloudflight

We have developed a structured approach to evaluating the potential of specific technologies concerning the relevance in the General Market, at Cloudflight, or in your specific company or organization. Let’s look at the general methodology first.

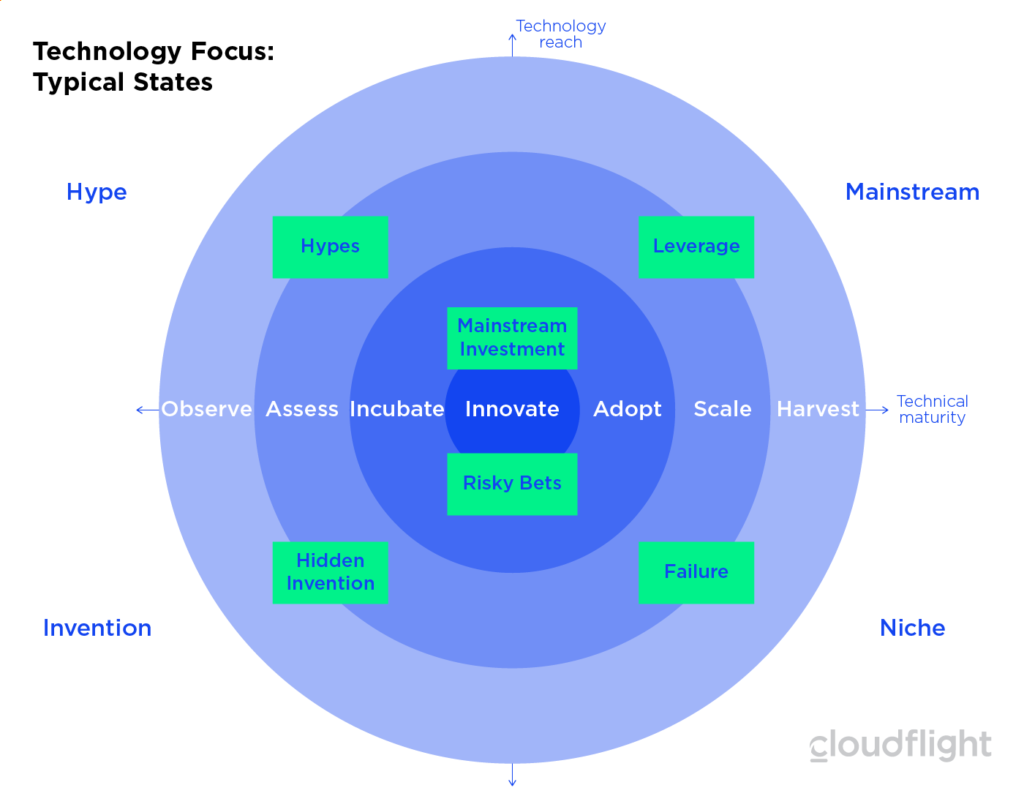

We place technologies along the horizontal axis depending on their maturity. To some degree, this is comparable to the positioning alongside the hype cycle. However, a mature technology is not automatically widely adopted. Home Automation is a good example. The technology is mature, yet consumer adoption is still far behind other consumer technologies such as smartphones.

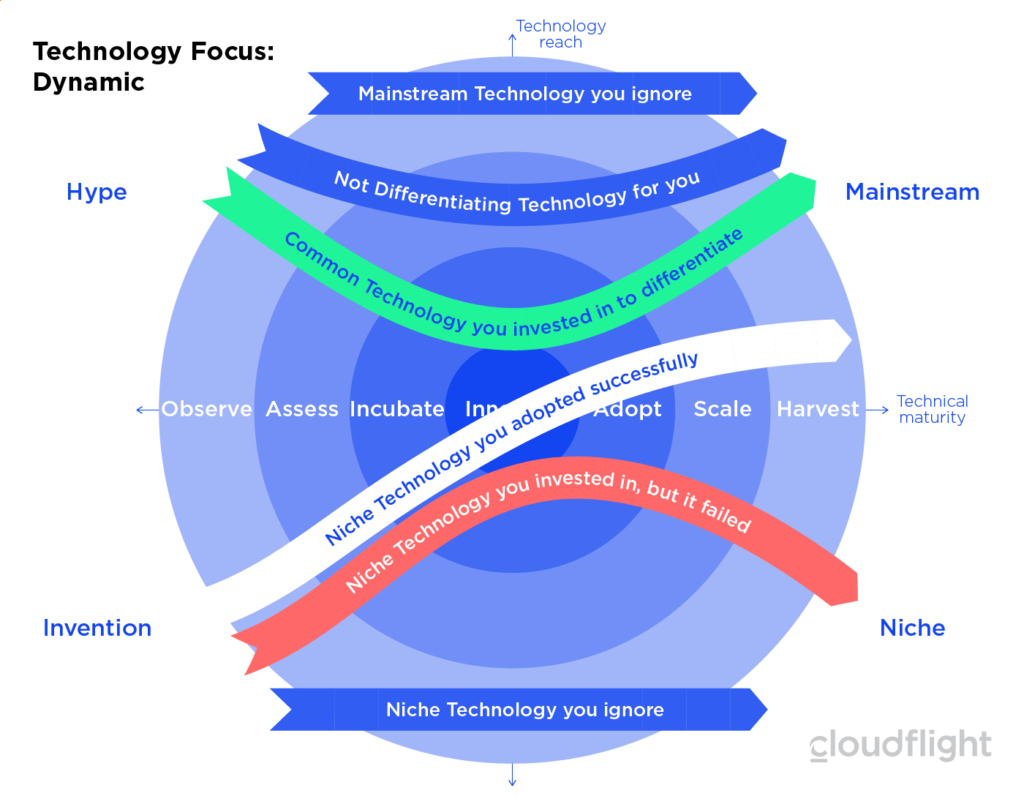

On the vertical axis, we rate the relevance of a given technology in the given perspective of the general user market, Cloudflight, or your company. The closer a technology is to the middle, the more relevant it is to you. The farther away it is, the less interest you will have in it. This allows us to put a technology in the upper or lower area of the portfolio if it has little relevance. In the upper sectors, we have technologies that go from hype to mainstream adoption. They may never go through your dark blue illustrated innovation focus if they are not really differentiating for you and therefore do not need your full focus. Packaged business software may take this route.

If a technology is not relevant to you, it is placed within the lower half of the illustration because it is likely to be a niche market that is not relevant to your industry or our innovation strategy.

To link those abstract positions to a portfolio map showcasing decisional guides for future investments, we add concentric circles as another element of our methodology. The more centered a technology is, the more we invest, devote management attention, and stimulate Innovation. At this position, it has high relevance to you on the one hand, and a sweet spot between technology being mature and the market not being saturated on the other. Thus, in contrast to purely analytical methods, with this center, we introduce an actionable aspect as a focus for spending on incubation, carrying out stimulus activities and striving for innovation in general.

As shown in Figure 2, you can characterize each technology along its life cycle AND with its relevance for your innovation strategy. At a given time, a single technology can be positioned among the following extremes:

- Mainstream Investment. The upper center of your current innovation focus stimulates technologies that are commonly known but might help with your differentiation in the future.

- Risk Bets. The lower center of your current innovation focus takes risks bets. You act as an early adopter.

- The upper left are commonly known new technologies you observe or assess but do not yet invest in.

- Hidden Invention. The lower left of the focus diagram shows hidden inventions you – but very few others – have identified at potential future investment area.

- This is a technology you widely adopt to drive and differentiate your core business.

- There are obviously many emerging technologies that failed to be adopted and became totally irrelevant to you.

- Technology you ignore. This can be either mainstream or niche technology, which is so far away from your value chain that you do not even assess it in detail.

- Not differentiating Mainstream Technology. As long as the path never goes straight through your innovation focus center, it is exactly the same as other companies might have access to. This includes also packaged business software such as the new SAP S/4 Hana. You might have to invest in the migration from legacy systems. However, the result is not a differentiating innovation for you, and you should not dedicate any real innovation budget to it.

- Common Technology you turned into differentiation. If you innovate further on technology that is hyped and therefore commonly accessible, you might be able to leverage this in a differentiating way. An example would be if you build on top of the above S/$ Hana System a unique piece of business software that none of your competitors have. Here is also a lot of business software that is currently written following the modern cloud-native architecture paradigm.

- Successfully leveraged niche innovations. Going from the lower left to the upper right crosses the risky bet of innovation. Not many large businesses do this, but it provides the most distinct differentiator in the market. The white line in Figure 3 usually provides the best momentum for startup and spin-offs.

- Adoption failures happen frequently. Risk bets and large hypes alike may fail to be adopted by your customers and may turn out to be irrelevant in your business. Hopefully, you did not invest much and the journey does not (or only slightly) reduce your innovation investment budget (e.g., red line in Figure 3). Again, the individual perspective is important. Blockchain, for example, turned out to be a significant mainstream technology for the financial services industry. However, if you are in logistics, blockchain goes from hyped technology to an irrelevant niche. Most of the large logistics platforms copy data from one company to the other along the supply chain. Many logistics companies do not have the scale to invest in a network of distributed blockchains across their partners.

We strongly encourage you to compare the new Technology Focus diagrams you create in the future with the initial versions. The art of technology innovation management includes avoiding making too many poor investments on promising hypes. If a technology goes from the upper left through the stimulation focus down to the lower left, you waste a lot of money. If you drag it down in the assessment or early incubation, it still hits the lower left but without your investment.

Cloudflight Technology Focus

Before going into details about Cloudflight and what is relevant to us, note that the advantage of our approach is that we can readily adapt the big picture to any other stakeholder’s perspective. While the other two aspects – technical maturity and technology reach – stand for themselves, we can re-evaluate the relevance aspect from different perspectives.

First, Cloudflight is a company that always wants to help its customers differentiate through digital innovation and unique software. Our relevance is therefore far away from customizing packages of mainstream software that are at the very top of the diagram. We also try to avoid overly small niches because only few customers would buy this from Cloudflight. That’s why our focus is in the middle of the diagram: high enough to avoid narrow niche market but also clearly below commoditized mainstream markets.

At Cloudflight, we have a strategic focus both when looking at technologies and when looking into markets. When it comes to technologies, Artificial Intelligence (AI) and Cloud Computing are our two strategic pillars. Those determine day-to-day decisions as well as our market positioning and customer relations. What is the value of technology evaluations when the technological focus is already there? The answer suggests time and granularity. We selected those strategically focused technology based upon evaluation. While it is irresponsible to stick to decisions that might be suboptimal in the face of changing environment and constraints, we strive, as a company, for a certain level of consistency – even in our rapidly evolving industry.

On the other hand, there are many sub-fields in AI and Cloud Computing. So many that it would not be efficient to follow up on all of them.

Along with the technological focuses, Cloudflight has defined focus industries – aerospace, automotive and mobility, plant engineering and machinery, the public sector, and transport and logistics. Not all technologies will influence all these industries to the same degree. This means that the potential market for a particular technology is influenced not only by the industries acting in the big picture but also by existing customer relations and contact with early adopters.

Independently from strategic considerations and market potential, we also evaluate existing or transferrable expertise within our team. To be precise, we identify the gap to close (i.e., the necessary investment to adopt new technology). Cloudflight is in the fortunate position of having highly motivated people on board. So even for new and emerging technologies, it is more than likely that some colleagues have completed a related master thesis or gained experience via private projects.

The last aspect to mention is that at Cloudflight, we co-create innovative software solutions in areas where our clients explicitly want to differentiate themselves from their peers. Therefore, we also evaluate the innovation model of technology – from being a same-level alternative to existing solutions to the potential of completely disrupting entire industries – and sustainability – from likely being replaced to driving innovation for many years to come.

Technology reach – the vertical dimension

Here we see two significant factors. An important aspect is how much impact a technology has on the value creation of a society or on the proportion of industries that are influenced or even disrupted. The other factor is how many people will come into direct contact with it. This can range from very few highly focused experts to practically every internet user around the world.

An example where we see the different aspects to aim at are cryptocurrencies (e.g., bitcoin). On one hand, relatively few people are in direct contact with this technology. Although some companies and even countries are allowing Bitcoin as official means of payment or are working on concepts regarding digital currencies, we are relatively far away from doing our everyday shopping in bitcoin. On the other hand, the total valuation of digital currencies is enormous compared to traditional fiat currencies. In April 2021, when bitcoin was at a temporal peak, cryptocurrencies amounted to an overall value of about $2 trillion. This is about the GDP of Italy, the eighth largest economy worldwide. See also ). We are quite aware that the value that has been created over the last few years is quite controversial. Nevertheless, it shows the potential of digital technologies.

Technical maturity – from left to right

Technical maturity (i.e., our horizontal dimension) also has various aspects. An obvious one is to investigate use cases and applications. Starting from basic academic research and going to applied research and industrial R&D projects, a technology finds its way into first proof of concept implementations and finally industrial use cases running production at scale.

With significant dependencies on this first aspect – but not necessarily correlated to it – we observe the development of ecosystems. This starts with a growing community around the initial inventor. When it has gained enough size, it is often backed by companies or foundations, thereby increasing sustainability. Later, a market begins to develop with various players – providers and retailers, consultants and system integrations, channel partners, and more.

For software technologies, we also differentiate on how to use or integrate them. In a community stage, it is often libraries, models, or datasets that are developed and maintained. There will later be commercial products on the market. In many cases, these are not libraries or frameworks for a license but rather APIs or services (XaaS, depending on the level of the technology within the software stack).

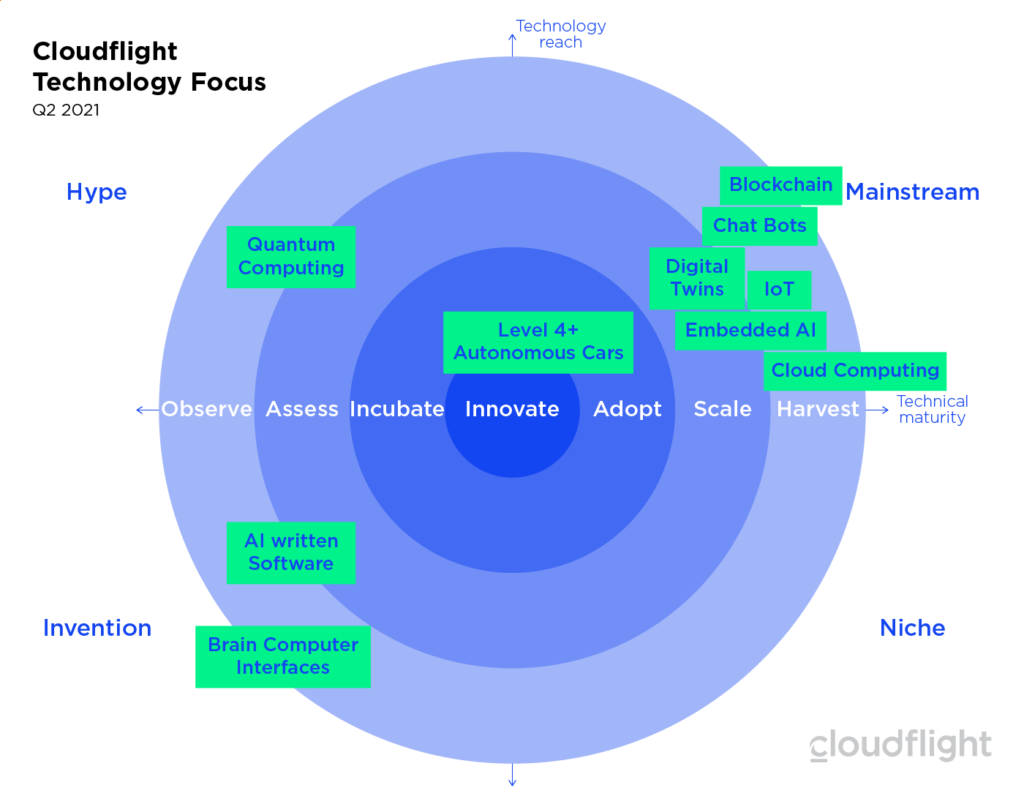

The Cloudflight Technology Focus – 2021

After providing these insights into our evaluation criteria, we share the 2021 Cloudflight Technology Focus in Figure 4. All major technologies we currently leverage in production and resulted in previous innovation activities are listed on the right. This is not on the granularity of specific programming languages but rather the major emerging technology areas of Cloudflight. The Technology Focus is always in motion and based on customer demand and our growth strategy. New technologies may be added shortly.

In upcoming publications, we will focus on selected technologies, highlight different perspectives, and, of course, give a periodic update on the Cloudflight Technology Focus.

- Quantum Computing might be self-evident as a hype – also regarding the definitions of the hype phase as described above. Even though a major player has already announced “Quantum Supremacy”, there has been criticism that this supremacy is even dubious in a theoretical domain and does not mean that Quantum Computers are ready for practical use. So, although there is Quantum Annealing hardware around and Quantum Simulators that can be programmed (e.g., a future Quantum Computer), we rate the technological readiness in the Cloudflight context as “observe”. Exploring the question of whether it will affect a niche or become a mainstream technology can be answered by thinking of cryptography and the fact that with Shor’s algorithm, a method is known by which quantum computers can break factorization-based crypto algorithms. Because those algorithms are quite popular today, almost every internet user will at least indirectly be affected. How relevant is Quantum Computing to Cloudflight? We see that this technology will be a game-changer for a large number of challenges. We have also gained some knowledge and are continuously observing the progress. What still needs to be proven is how fast the demand and market for custom solutions will be growing. Finally, the motion to the right might be quite low. And there is still the likelihood that Quantum Computing will remain in the realm of academic high-performance computing for another five years

- Brain–Computer Interfaces is a similar example. We see that hardware is the limiting factor here as well (at least when we are looking at non-invasive methods), thereby making it a field for intense hardware/software co-development in an R&D context. However, in contrast to Quantum Computing, we see Brain–Computer Interfaces applied in the medical domain only. This makes it a niche market with a highly specific focus. Because Cloudflight has currently not put a specific focus on the healthcare industry, the technology is not particularly relevant to us.

- Blockchain is widely used – especially in the context of cryptocurrencies. Although energy consumption (e.g., of the bitcoin network) is controversial and there are ideas on how to improve, the technology needs to be rated as in a “harvest” state. A simple reason is an enormous economy that is already building up around cryptocurrencies. At Cloudflight, we developed an interest in the Blockchain some years ago. Throughout the first Bitcoin hype in 2017, we observed the overinflated expectations at their finest. We evaluated whether to apply Blockchain and distributed ledger technology for numerous use cases. For most of them, we identified more disadvantages than advantages, and blockchain did not move fully through our innovation focus. As of this moment, we are satisfied to see those expectations of what could be achieved with Blockchain have become realistic ones.

- RPA Macros – Routine task automation is a huge topic with lots of optimization and cost-saving potential. RPA and macro recorder-like products have been on the market for quite some time. You might therefore think that this technology also is a candidate for mainstream use. Explaining our rating on the matter requires us to look at the timeline and the maturity of other technologies. Here, we see the rise of AI and intelligent document processing technologies as significant competition. To be specific, we expect these to become mainstream technologies, whereas pure RPA macros will remain only niche technologies.

- Not an exhaustive list – a few technologies are missing because we have not investigated enough to position them. However, the vast majority not on Cloudflight’s own perspective in Figure 4 is deliberately missing. It is either a niche or a mainstream technology that we have decided to ignore at this point in time. Why are we ignoring SAP’s Hana mainstream platform? We believe that many enterprises use it in exactly the same way their peers are using it without much differentiation. Thus, is does not fit to your strategy focusing on digital differentiation with our customers. Second, the service provider market for SAP implementations is already a crowded market, and we would hardly gain market share organically as a new entrant. That’s why we team up with other companies if our customers need SAP related services.

In upcoming publications, we will focus on selected technologies, highlight different perspectives, and, of course, give a periodic update on the Cloudflight Technology Focus.

Conclusions

In summary, we have developed a structured approach to identify how to focus your (our) innovation. It can be used in a general market perspective and individual corporate innovation strategy exercise in order to fully understand what matters most in Cloudflight’s own perspective. In addition to more general research such as the hype cycle and technology radars, the Technology Focus methodology by Cloudflight incorporates your own (or our) perspective of a differentiating position around your (our) entrepreneurial context, market position, and existing expertise.

We encourage you to facilitate the Technology Focus method yourself to not only rate technologies or trends but also derive actions. You can reach out to us as an advisor helping to define the very own technology and innovation strategy.

Stay tuned to review our further reports on a General Technology Focus or specific perspectives for certain industries. We will also use this methodology to publish the current position and potential journey of specific technologies in dedicated articles. We are regularly discussing the Technology Focus with likeminded decision makers and CxOs in Cloudflight in our monthly Digital Leader Community Call. Beyond this, you are encouraged to share a personal perspective or the technology you’d like us to evaluate soon. Mario Herger (2019) The last driver’s license holder has already been born.

- Fraunhofer (2021) Curtain up: Fraunhofer and IBM to unveil quantum computer. https://www.fraunhofer.de/en/press/research-news/2021/june-2021/fraunhofer-and-ibm-to-unveil-quantum-computer.html

- Paul Benioff (1980) The computer as a physical system: A microscopic quantum mechanical Hamiltonian model of computers as represented by Turing machines. Journal of Statistical Physics. 22 (5)

- Everett M. Rogers (1962) Diffusion of Innovations, Glencoe.

- Geoffrey Moore (1991, revised: 1999, 2014) Crossing the Chasm: Marketing and Selling High-tech Products to Mainstream Customers. Harperbusiness

- Bloomberg (2021) Crypto Market Cap surpasses $2 trillion after doubling this Year. (published 05. April 2021) https://www.bloomberg.com/news/articles/2021-04-05/crypto-market-cap-doubles-past-2-trillion-after-two-month-surge