- The Hannover Messe, one of the world’s biggest industry fairs, confirmed it again: Germany is totally excited about the Industry 4.0 initiatives.

- However, CEOs, innovation managers, CIOs, and corporate strategy people have not uncovered their biggest business opportunities – the innovation via IoT business models.

- This Crisp Research Analyst View offers an actionable guidance to categorize innovation models in your enterprise and avoid the Industry 4.0 trap.

<!–more–>

Germany should have the best environment to innovate around IoT. A country full of engineers and economically strong enough to turn invention into innovation successfully on the market. But, what’s wrong? Amazon’s Alexa and Google’s Assistant are flooding the market with smart devices enabling natural language processing with a bit of artificial intelligence in the cloud backend. At the same time, you cannot even use the voice interface of a leading German luxury car to order a pizza arriving on time with you at home.

Although nearly everybody in the German manufacturing and high-tech industry including the majority of exhibitors at the Hannover fair are really excited about “Industrie 4.0”, nearly nothing reaches end customers as visible innovation related to physical products. So, what’s wrong with the German “Industrie 4.0” initiative and what’s the relation to the global IoT hype?

The term “Industrie 4.0” is based on a research union initiated by the German government and a project as part of the German Hightech-Strategy, which was formed between the German government and multiple lobby organizations of the German manufacturing, electronic and software industry.

(See https://en.wikipedia.org/wiki/Industry_4.0 but also the German Wikipedia page which has https://de.wikipedia.org/wiki/Industrie_4.0)

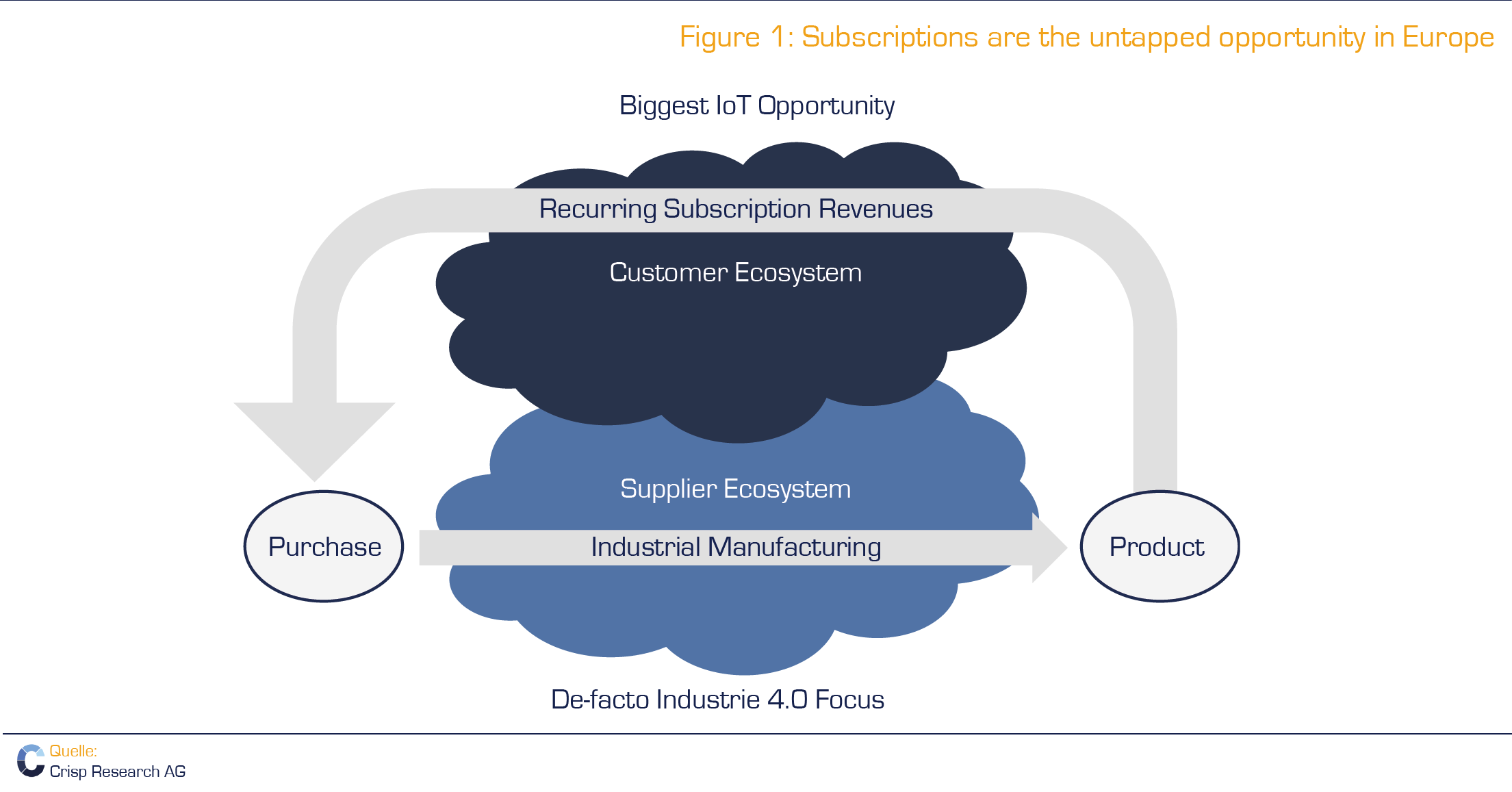

The actors of the Industrie 4.0 initiative had initially the next level of manufacturing in mind, but then expanded the scope to the full life cycle of a modern product. This is similar to the industrial internet consortium, IIC, which even claimed a more holistic understanding of physical and digital products, but achieved in general less traction than the Industrie 4.0 initiative. Unfortunately, the predominant resonance of Industrie 4.0 is really focused on industrial manufacturing and new digital products complementing physical products or a deeper understanding of new subscriptions revenue in the after sales market is totally underdeveloped.

The German industry and its lobby organizations steering the Industrie 4.0 activities, need to re-adjust the priorities urgently. Embracing digital products and IoT-related business models complementing the successful physical products is key; no matter if it is around cars, washing machines, or any other high tech product. In detail, chief digital- or chief innovation-officers need to follow these directions:

- Give Industrie 4.0 initiatives in Germany LESS priority. Don’t relax if your company has started (multiple) Industrie 4.0 initiatives. This might bring the industrial manufacturing on a new level, but will not deliver new digital products or generates additional and recurring revenue streams for your business.

- Understand digital products. Many industries, including automotive, have still a fundamental problem embracing the next generation of the after-sales market momentum. In the last decades, most large manufacturers focused on harvesting the spare part business and selling to their dealership. Now, the new after-sales momentum is about end-customer relationship and loyalty – no difference if the end use is a business or consumer persona.

- Leverage the supplier and customer ecosystem. Industrie 4.0 provides in many cases actually a real breakthrough towards a new value chain across suppliers, part manufacturers, manufacturers, OEMs, and distribution channels, which forms the supplier ecosystem. However, Industrie 4.0 is very little helpful to understand the opportunities in the new customer ecosystem. Imagine an iPhone or Android without the millions of 3rd party apps! That’s actually what a Dashboard on the majority of modern cars looks like! Mobile device vendors including Apple and Google generate over 2,5 years another subscription revenue stream in the same size of the original device purchase price. Customers are paying ongoing money for music streaming or cloud storage, and 3rd party vendors are paying royalty fees to sell apps through the monopolistic app stores – all driven by ease-of-use and customer convenience. At the same time, my car isn’t even able to share the fuel price of the recent stations with my friends, or publish some of the existing sensor data such as road conditions in a social networking style. Given the amount of time, many people spend in their cars, it’s a valid question why only mobile carriers partner with OTT (OTT means over the top providers, which offer services independent of the telco carriers) providers like Spotify or Amazon, or the music streaming services from the device vendors like Apple? Why isn’t BMW, Daimler and Volkswagen integrating Spotify into their Dashboard and generate a subscription stickiness with their end customers?

- Link the supplier and customer ecosystem together. Especially in the after sales market of technologically complex products, the interaction between the supplier and customer ecosystem is essential. Customers – both consumers and business customers – like to understand from their peers, where to get competent service around their expensive devices. Another possible synergy between these ecosystems is the evolution of the physical or digital product itself. Although most luxury cars have a speech interface today, I can not give feedback about the car itself, or tell the map-subscription “I found a new street, not on your map yet….”.

Mind the Fake-Industrie 4.0!

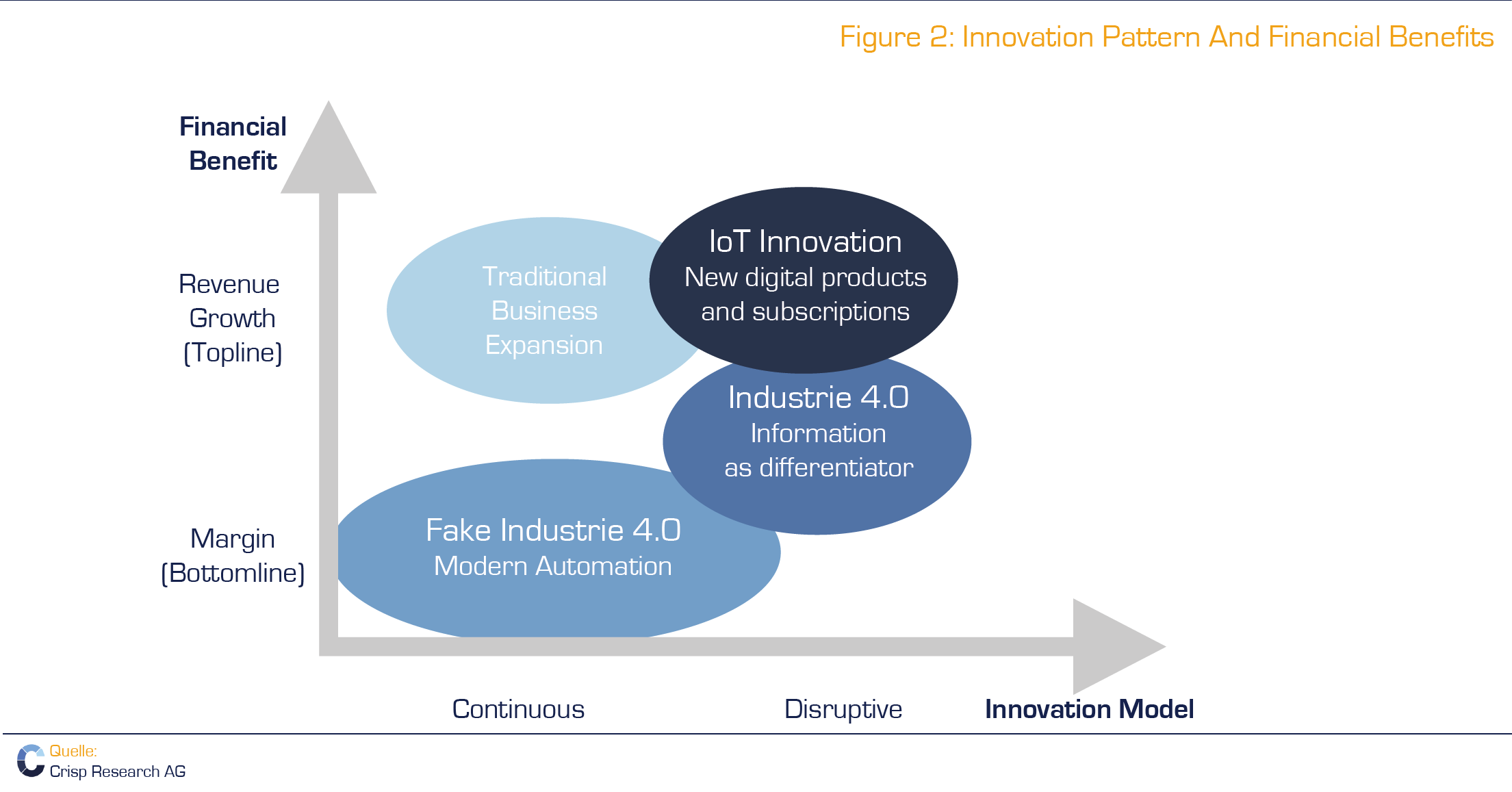

In addition to the understanding of subscription based business models and the two ecosystems above, innovation managers should explore specifically for their industry the relation between innovation pattern and financial benefit. Crisp Research recently screened and classified many Industrie 4.0 cases presented at the Hannover Industry Messe:

It turned out that there is the following relation between innovation models and the financial benefit:

- Real Industrie 4.0 Innovation. These projects are mainly focused on the industrial manufacturing process in a “digital factory”, which really turn information into a differentiator. This is in line with the mindset of the original Industrie 4.0 thought leaders and the key differentiator compared with the 3rd industrial revolution, the digital automation. Many Industrie 4.0 cases add a consistent information flow along the whole supply chain and stimulate a much better collaboration than ever before. The ideal Industrie 4.0 case is actually a disruptive innovation. Fake-Industrie 4.0. Inline with an analysis of the German Bitkom organization last year, a majority of the so-called Industrie 4.0 solutions would have earned not more than a “Industrie 3.5”-label. Actually, most of the Industrie 4.0-labeled solutions showed only continuous improvements to manufacture products at superior quality and cheaper price. All of this value is hidden to the customer and contributes to a better margin of the manufacturers only. A continuous improvement of automation within an enterprise has little to do with the disruptive ideas of Industrie 4.0. Only if the improved value generation is really achieved by things that you did not do qualitatively before, such as real-time sharing of information across the supply chain, and not only within the own enterprise, you should claim an disruptive Industrie 4.0-innovation.

- Real IoT Innovation – Visible for customers and revenue growth for vendors. The most exciting, but unfortunately least spread innovation of the German IoT spectrum, have a lot of customer visibility. It establishes new digital products with additional revenue streams and is obviously disruptive. Most IoT achievements from North America are following this pattern. Some outstanding start-ups from Europe such as the block-chain driven electric car charging station, are examples of disruptive innovation linking the ecosystem of electricity providers with the ecosystem of e-mobility users and create new e-roaming revenue streams or car sharing options..

- Traditional Business Expansion if technology agnostic. The continuous exploration of new markets as part of the globalization does in fact provide additional revenue streams for many companies, but is in most cases not a disruptive innovation model. IoT technologies are not specifically contributing to this pattern more or less than any commodity technology.

Based on this, innovation managers of European firms can now categorize their projects in the different innovation patterns. Most of you cannot and must not ignore the potential of a real IoT innovation. A cool IoT project always starts with a business model or a design thinking workshop, but NOT with the analysis of a current manufacturing process and its possible improvements. This leads to Industrie 4.0 and in many cases even only an Fake-Industrie 4.0 scenario.

Crisp Research has seen only a few Industrie 4.0 examples, which made it into a top-line revenue contribution. One case is the Industrie 4.0 based mass customization of products. Manufacturers used to produce large volumes of identical pieces and usually sell them through B2B channels. Now, they suddenly interact directly with their end-customers and manufacture individual pieces at nearly the same cost like the large volumes before. This is obviously very disruptive to the business model and only achievable in a profitable way by a mature Industrie-4.0 manufacturing process.

The majority of disruptive innovation on the global market today is based on new business models, many combined with IoT technology, but most of them totally unrelated to the industrial manufacturing process itself. The European industry needs to acknowledge the situation and must not miss the chance, while being so excited about Industry 4.0.